Best phone insurance 2018: Protect your iPhone or Android smartphone from £3.15 a month

On November 11,2021 by Tom Routley

It’s never been more important to have phone insurance. As our phones get smarter, they also seem to get more fragile. Gone are the days of the indestructible Nokia 3310, which could survive a tumble down the stairs as if nothing had happened.

Phone insurance may seem like an irritating and unnecessary extra expense, but it could save you forking out for a new handset, or paying to fix a smashed screen. Read on, and we'll show you some of the best phone insurance options that won’t break the bank.

How to choose the best phone insurance for you

Are you likely to damage or misplace your phone?

You already know whether you’re the kind of person who’s likely to break their phone. If you’re always dropping things and perpetually smashing your phone screen, you don’t want to be forking out for a new phone or an expensive private repair every time. Having an insurance package that covers accidental damage will be crucial. Likewise, if you regularly find yourself misplacing your phone, make sure you sign up for a phone-insurance package that covers loss and theft .

Could you survive without your phone?

How long could you survive without your phone? If you can happily get by for a week or more with a shoddy interim handset, there are some very cheap options on the market that may suit you. But if you need a next-day replacement , chances are the price will be higher.

Is your phone already covered?

Before you sign on the dotted line for a phone-insurance package, it’s worth checking whether your smartphone is already covered by a different policy. For instance, your home insurance policy may well cover gadgets and devices up to a certain value, which could well include your mobile. Also, if it is a work phone you’re looking to protect, you should check first whether this responsibility is yours or your employer’s. Additionally, if you have gadget cover insurance already, this will probably cover your phone. If your phone isn’t covered by your home insurance, your employer or an existing gadget cover policy, you should definitely invest in a dedicated phone insurance policy.

Could you benefit from bank accounts with phone insurance?

Going through your phone provider to get phone insurance may be the tried-and-tested method, but there’s an increasing number of other ways to get your mobile covered. A phone insurance with bank account could be beneficial for you: most banks will offer phone insurance as one of several perks associated with a special bank account, so you could well get travel insurance and all sorts of other cool stuff thrown in. On the more negative side, however, getting insurance through a bank instead of a phone provider means you can’t just pop into a shop and ask when you have any problems or questions.

Why get phone insurance through a network?

One of the biggest benefits of insuring your phone through your network is that – if it’s a big network – you’ll be able to walk into high-street store at any point, saving you from having to wait on hold to get it sorted. If you have a bigger issue that necessitates your phone being sent off for repairs, most high-street phone providers can immediately set you up with a temporary replacement handset. It is also becoming increasingly common for phone networks to replace faulty handsets like for like on the day after your claim is made. Dealing with banks or online-only insurance outlets may save you money and provide other perks, but when your phone is out of action, the ability to replace it that quickly is arguably the most important thing.

READ NEXT: The best budget smartphones you can buy today

The best phone insurance to buy

1. Insurance2Go: The best smartphone insurance on a budget

Price: From £65 per year | Buy now from Insurance2Go

Insurance2Go has emerged as the most affordable place on the web to buy phone insurance, offering flexible policy options to suit various types of customers and all types of phone. As long as your smartphone is less than six months old and you’re over the age of 18, you should be able to find a package that matches your needs. The Standard Cover option is available for £5.99 per month or £65 per year, and it covers both loss and theft. The Full Cover package adds accidental damage, liquid damage, malicious damage and mechanical breakdown to the list of problems covered, at a price of £7.49 per month or £79.99 per year. Both packages include accessory cover up to £150, overseas cover for 90 days a year and e-Wallet protection up to £100.

Buy now from Insurance2Go

Key specs – Excess: £75; Insurance covers: You and your immediate family; Contract length: No contract; Wait for replacement phone: Unspecified; When you can sign up: Within six months of getting the phone

2. Gadget Cover: The cheapest phone insurance for older devices

Price: From £35 per year | Buy now from Gadget Cover

If you’re looking to insure an older phone, Gadget Cover has some highly affordable options. Although it would be cheaper to fully cover an iPhone X via Insurance2Go, it’s tough to beat price points of Gadget Cover when it comes to covering not-exactly-cutting-edge phones. If your phone is valued at less than £150, Gadget Cover will offer you a policy that covers accidental damage, liquid damage, breakdown, theft and worldwide cover for just £3.15 per month (or £34.65 per year). Adding loss cover to the policy brings the price up to £4.15 per month (or £45.65 per year). Either way, this is a very affordable way to protect older handsets.

Buy now from Gadget Cover

Key specs – Excess: £50 or £75, depending on the device; Insurance covers: You and your family; Contract length: Minimum term 12 months; Wait for replacement phone: Unspecified; When you can sign up: Within 18 months of purchasing your phone

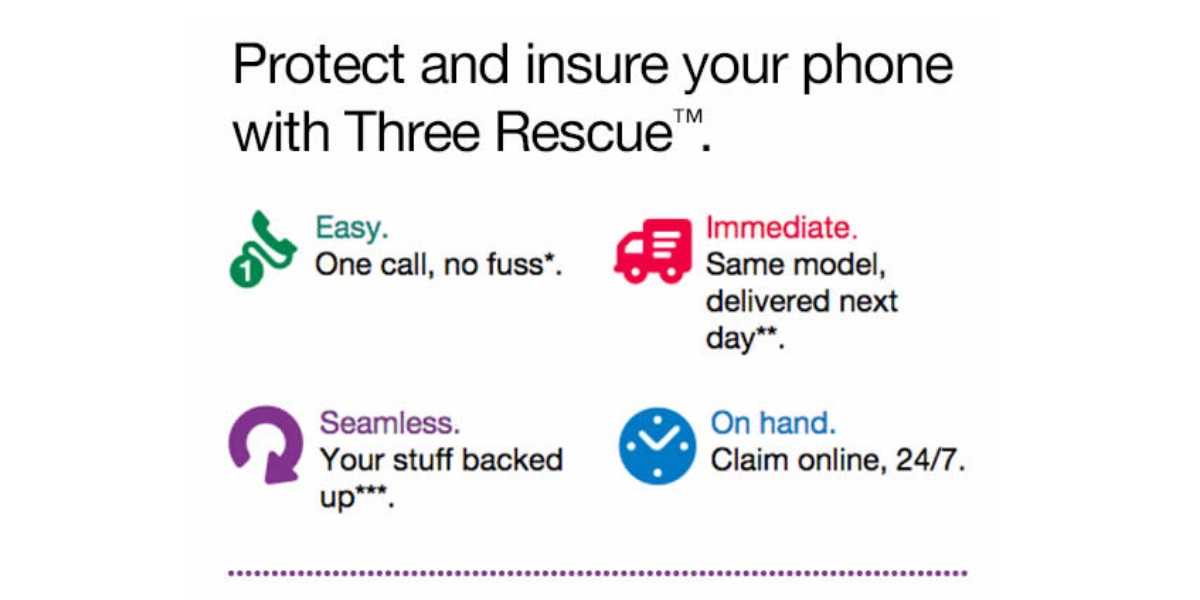

3. Three Rescue: The best phone insurance through a network

Price: From £102 per year | Buy now from Three Rescue

Out of the vast array of phone networks, Three currently offers the cheapest insurance packages. Their website has an easy-to-use price checker that allows you to instantaneously discover the price of covering your phone, with most iPhone and Android devices priced at £8.50 per month for the Damage Cover package. That works out at £102 per year, which gets you covered for accidental damage, malicious damage, liquid damage, pet damage and out-of-warranty breakdown. You can pay more to get the Full Cover package, which adds loss and theft to the list of issues covered. Overseas travels are covered with both packages, although replacement devices can only be sent to addresses in the UK or the Channel Islands.

Buy now from Three Rescue

Key specs – Excess: £80 for most devices; Insurance covers: You and any family or friends to whom you lend the phone; Contract length: Matches your phone contract; Wait for replacement phone: Dispatched next day, after your claim is approved; When you can sign up: Only when buying a phone or starting a contract

4. Nationwide FlexPlus: The cheapest family phone insurance through a bank

Price: £156 per year | Get a Nationwide FlexPlus account now

If you’re looking for a bank account that can double up as phone insurance for your entire family, the Nationwide FlexPlus account could be perfect for your needs. For £13 per month (£156 per year), Nationwide’s FlexPlus account will cover any phones priced under £1,000 that belong to you, your partner,and any children under the age of 19. Phones belonging to children aged between 19 and 22 can also be covered while the child is at home, as long as the child in question is in full-time education. Nationwide’s Worldwide Cover option includes loss, theft damage and fault all over the globe. Other perks of the FlexPlus bank account include worldwide travel insurance and car-breakdown assistance in the UK and Europe.

Get a Nationwide FlexPlus account now

Key specs – Excess: £50 or £100, depending on the device; Insurance covers: You and any family; Contract length: As long as you have the bank account; Wait for replacement phone: Unspecified; When you can sign up: At any time

5. Natwest Silver Joint Account: The best-value phone insurance for two people

Price: £144 per year | Get a Natwest Silver Joint account now

If you're looking for a cheap way to insure you and your partner's phones, you can set up a Natwest Silver Joint Account and simultaneously obtain mobile phone insurance for both named owners of the account. The cost of having a Natwest Silver Account, be it for an individual or as a joint account, is £12 per month (which adds up to £144 per year). The phone insurance package included with the account covers theft, accidental damage and breakdown. Other benefits of setting up a Natwest Silver account include travel insurance, a Taste Card for restaurant discounts, and 25% cashback on tickets for events.

Get a Natwest Silver Joint account now

Key specs – Excess: £100; Insurance covers: The two named owners of the account; Contract length: As long as you have the bank account; Wait for replacement phone: Unspecified; When you can sign up: At any time

Article Recommendations

Latest articles

Popular Articles

Archives

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- January 2021

Leave a Reply